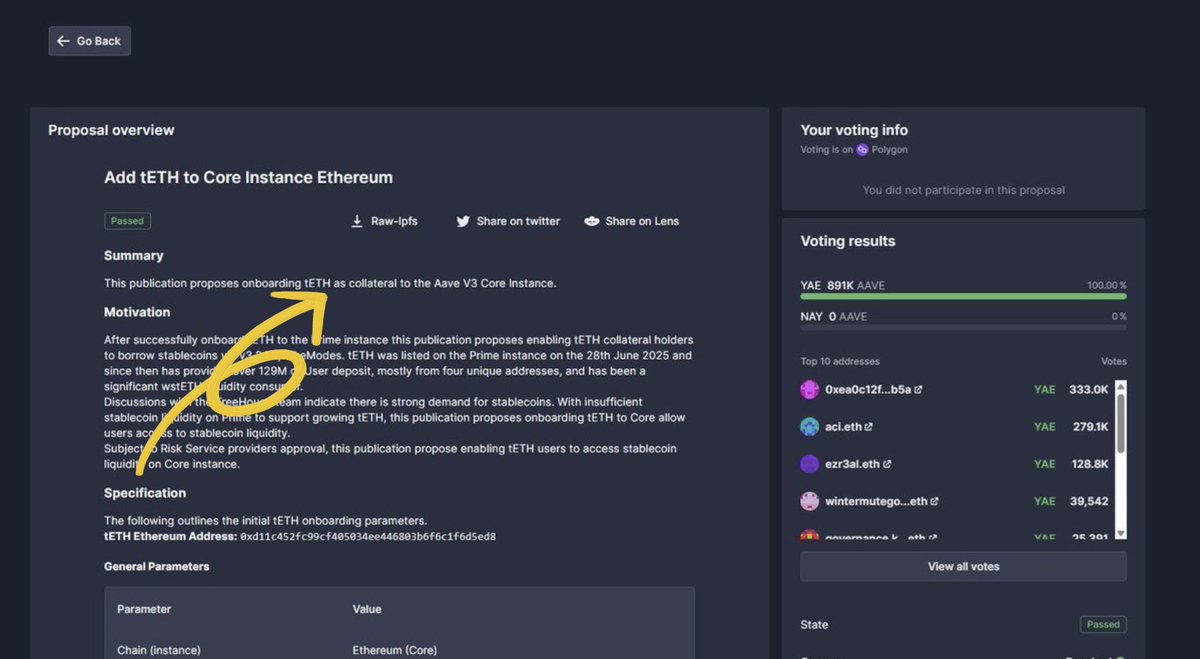

Aave just approved tETH for their Core Instance.

Here's why this matters:

tETH is essentially a leveraged staking wrapper that runs through Aave itself. Now users can borrow stablecoins against this already max-leveraged position.

It's recursive leverage on recursive leverage.

This exact trade caused massive losses just weeks ago from a minor rate spike. Withdrawal queues are at all-time highs, spreads at all-time lows.

Even worse: tETH is already on Prime Instance too, so any isolation between markets is gone. Bad debt contagion flows everywhere.

Aave's risk profile has objectively been getting riskier w/ increased collateral exposure to Ethena, and tETH pushes it even further out on the risk curve, imo.

While I love Aave and am not trying to be a doomer here, I'd expect institutional capital onboarding to DeFi lending rails to gravitate toward Morpho vaults over Aave.

w/ Morpho, institutions get customizable risk parameters that are immutable and can select which specific risk/market exposure they want.

+ This is already where the majority of DeFi curation happens (Steakhouse, Gauntlet, etc).

Look at Coinbase's cbBTC market success on Morpho as an early preview (8% APY while only being exposed to super blue-chip collateral in cbBTC).

TradFi will choose to curate capital with Morpho vaults while fintechs (Coinbase, Robinhood, Revolut etc) bring these curated markets to retail.

Much easier to plug and play the markets with parameters they can more effectively underwrite and remain compliant with.

23.44K

111

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.