Plasma price

in USD$1.241

+$0.5203 (+72.10%)

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

Market cap

$2.27B #38

Circulating supply

1.85B / 10B

All-time high

$1.447

24h volume

$7.08B

About Plasma

New

Layer 1

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Plasma’s price performance

Past year

--

--

3 months

--

--

30 days

--

--

7 days

--

--

Plasma in the news

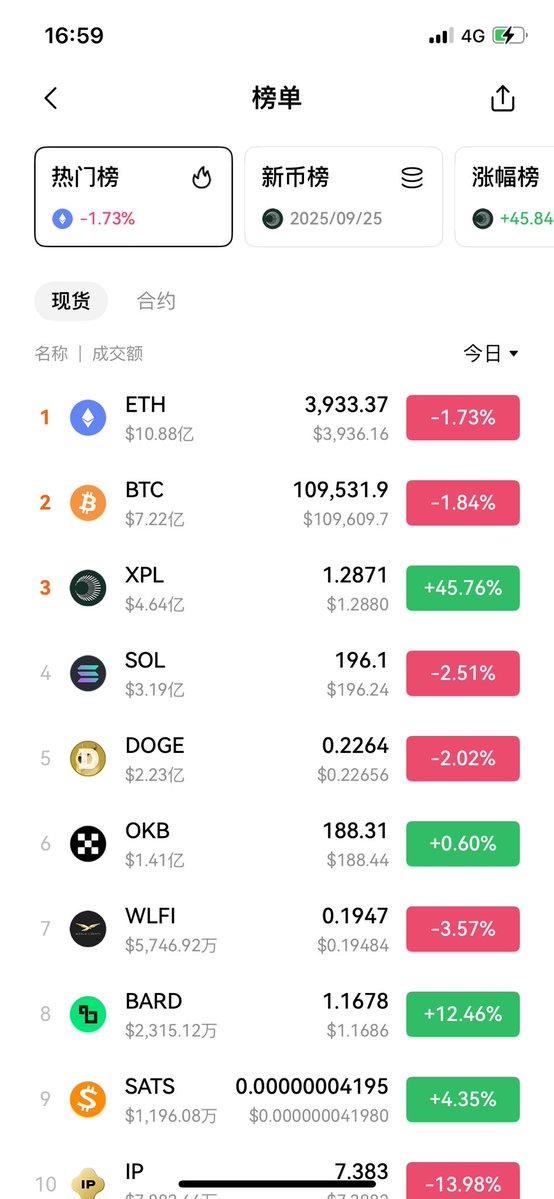

XPL functions as a gas token, staking asset, and reward token, with a total supply of 10 billion tokens.

Also: Plasma to Launch Mainnet This Week, New Liquid Staking Token for XRP Holders, and ICP Bets Big on AI Tech Stack.

The rollout comes ahead of Plasma’s mainnet beta launch on September 25.

Plasma today announced a token distribution for contributors to its public sale, with eligibility verified...

The team claims that the network will debut with more than $2 billion in stablecoin liquidity.

The deployment marks first syrupUSDT launch beyond Ethereum as Maple targets $5B in assets by year-end.

Plasma on socials

I believe many people feel regret for missing out on @PlasmaFDN, and have expectations for Tether's other stablecoin chain @Stable. Of course, there is also confusion about why @Tether_to is pursuing a dual strategy of Plasma + Stable? Will Stable issue a token? What exactly does Tether, the king of stablecoins, intend to do? Let's discuss my understanding:

In simple terms: Tether's "dual sword strategy" with Plasma and Stable is actually aimed at reclaiming the "market dividends" that have been benefiting Ethereum and Tron for years, achieving a significant leap from being a stablecoin issuer to a global payment infrastructure.

1) First, let's talk about reclaiming the cake. Currently, USDT has a market cap of $170 billion, with an annual trading volume that even exceeds the total of PayPal and Visa. However, Tether can only earn 3-4% in government bond interest. Although the annual profit is around $13 billion, it pales in comparison to the actual value it creates. How do we understand this?

For example, USDT is a key component of DeFi liquidity, and the transaction fees it generates each year actually go to the Ethereum network (which has fluctuating gas fees). This portion of the fee cost is borne by users and captured by the Ethereum network, while Tether does not profit from it. If Tether's own stablecoin chain is launched, theoretically, this portion of transaction fees could be included in their revenue.

Additionally, it is well-known that Tron has profited immensely from the payment demand for USDT, with Tron’s revenue in 2024 expected to be around $2 billion. Tether cannot directly benefit from this money either.

Therefore, the direct motivation for Tether to pursue the dual strategy of Plasma and Stable is to reclaim the USDT transaction fees, payment service fees, and other DeFi ecosystem revenue rights that have been controlled by Ethereum and Tron for years.

This severely limits Tether's control over its vast USDT stablecoin economy. As the infrastructure of Plasma and Stable matures, it is time to reclaim these long-given dividends;

2) So, how should we understand the positioning of Plasma and Stable?

Plasma $XPL is a stablecoin chain supported by Tether's sister company @bitfinex and backed by investments from @peterthiel. It is positioned for the consumer end, providing security and censorship resistance through Bitcoin. Its killer feature is to challenge PayPal's payment position in the TradFi space while integrating over 100 DeFi protocols to siphon off native crypto yields;

For instance, the Plasma One neo bank product matrix offers a 10% passive savings yield and a 4% cashback debit card. If there are no regulatory obstacles, it will definitely create a stir in the traditional payment arena, capturing market share from old payment systems like PayPal;

Moreover, Plasma has integrated the entire crypto infrastructure through EVM compatibility, aiming to incorporate profitable protocols like @aave and @ethena_labs into its revenue landscape, thereby solidifying the interest advantage of its debit card. Otherwise, why would Plasma One be able to offer a 10% savings yield in addition to the 4% government bond yield?

Additionally, Plasma has introduced dedicated channels that subsidize users' gas fees through a paymaster, transferring the network congestion costs required for navigating the crypto DeFi ecosystem onto the protocol itself, achieving zero-fee interactions, which is highly attractive to end users.

Stable, on the other hand, is a "pure USDT" stablecoin chain that Tether plans to issue, designed as a payment chain for the business end, using USDT as gas fees and settlement layers, likely focusing on payment settlement scenarios.

Based on this understanding, we can answer two of the questions that everyone is puzzled about:

1. Will Stable issue a token? According to the latest interview with Tether CEO @paoloardoino, Stable will minimize complexity and will not add an additional token mechanism. In other words, there will not be a new token for now; $USDT is the token it will issue;

2. What is the significance of Stable's existence? It is likely to replace Tron's USDT ecosystem position, aiming to integrate B-end payment channels. For example, it recently introduced PayPal's PYUSD, indicating that Stable intends to serve as a settlement layer between stablecoins, further reinforcing USDT's position as the leading stablecoin.

Moreover, if Stable issues a new token, it would directly impact XPL's ecological value capture ability. Plasma and Stable can completely interoperate, using XPL tokens to incentivize channel partners on Stable, helping various stablecoin issuers better utilize Stable for settlement while connecting to Plasma to capture the siphoning value of the entire USDT ecosystem.

That's all.

So, if Plasma's ambition to reconstruct traditional payment infrastructure by targeting PayPal is realized, and if it achieves its goal of reclaiming the economic vitality of the DeFi stablecoin ecosystem, would you still think that the current $12B FDV is high?

Of course, business ambitions and actual implementation are two different matters. Ethereum, Tron, and other native crypto ecosystems will not sit idly by while Plasma seizes market share, and user migration will also require time costs. Traditional payment giants like PayPal and Visa will not easily surrender either. What if Plasma One's 10% savings yield is deemed illegal by regulators? And so on.

Clearly, there are still many variables behind this. But one thing is certain: Tether has been in the stablecoin issuance business for years and is now aiming for a grander goal of becoming a global payment infrastructure giant.

Whether it can be achieved is not important; what matters most is how many opportunities we can seize during this process!

2025 timeline be like:

january - sol ath. sol flipping eth

april - eth dead. whales exiting

july - eth is the world infra. to da moon. sol trash

august - hyperliquid true disruptor. only higher

september - hyper losing to aster. cz the king

september - plasma/xpl wins users. tether $500b company

september - missed plasma/xpl. getting on falcon finance

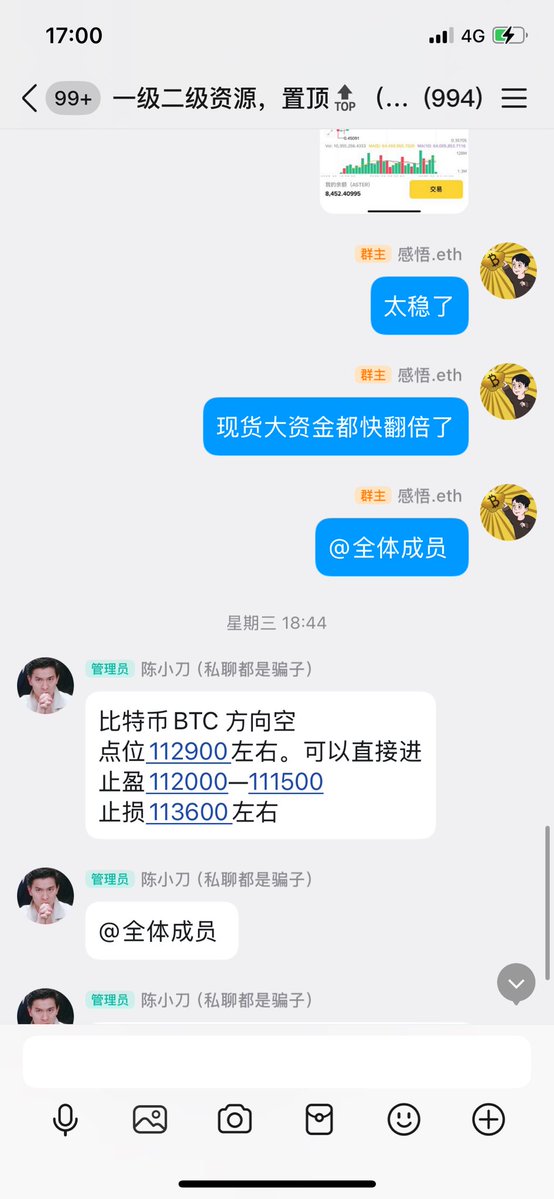

It's the end of the month again, and the familiar script is airing on time -- the market is crashing down from its peak, and the routine is still the same, just like from the end of last month to the end of this month. The only difference is that the people who are stuck either changed or someone else fell into the trap again.

In fact, whether you're stuck from going long or short, the essence is the same. To get out of the situation, the key hasn't changed: you need to adjust your position at the right time to climb out of the mire.

Remember this phrase: as long as your position is still there, there is still hope.

If you're currently stuck, don't panic, the insights are waiting for you here.

Eight years in crypto has cultivated the vision to navigate through bull and bear markets. #BTC

Guides

Find out how to buy Plasma

Getting started with crypto can feel overwhelming, but learning where and how to buy crypto is simpler than you might think.

Predict Plasma’s prices

How much will Plasma be worth over the next few years? Check out the community's thoughts and make your predictions.

View Plasma’s price history

Track your Plasma’s price history to monitor your holdings’ performance over time. You can easily view the open and close values, highs, lows, and trading volume using the table below.

Plasma on OKX Learn

Stablecoin Payments Revolutionized: How Plasma Delivers Zero-Fee USDT Transfers and More

Introduction to Plasma and Stablecoin Payments The rise of stablecoins has revolutionized the cryptocurrency landscape, offering a reliable medium of exchange and store of value. However, challenges s

USDT, Plasma, and Mainnet: Everything You Need to Know About the Revolutionary Stablecoin Blockchain

Introduction to Plasma and Its Mainnet Launch Plasma is a revolutionary Layer 1 blockchain designed to transform stablecoin transactions and liquidity. With its mainnet beta launch scheduled for Septe

Plasma, Tether, and Blast: Unveiling Solar Eruptions and Stablecoin Market Dynamics

Plasma Eruptions: A Spectacle of Solar Activity The Sun recently unleashed two massive plasma eruptions, marking one of the most dramatic events of Solar Cycle 25. These eruptions, captured in stunnin

Swarm and Tokenized Plasma: Unlocking 24/7 Trading with Tokenized Equities

Introduction to Swarm and Tokenized Plasma The decentralized finance (DeFi) landscape is undergoing a rapid transformation, and Swarm is emerging as a key player in this evolution. As a regulated DeFi

Plasma FAQ

Currently, one Plasma is worth $1.241. For answers and insight into Plasma's price action, you're in the right place. Explore the latest Plasma charts and trade responsibly with OKX.

Cryptocurrencies, such as Plasma, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Plasma have been created as well.

Check out our Plasma price prediction page to forecast future prices and determine your price targets.

Dive deeper into Plasma

Plasma is a Layer 1 blockchain designed for stablecoins, aiming to offer high performance, scalability, and security.

ESG Disclosure

ESG (Environmental, Social, and Governance) regulations for crypto assets aim to address their environmental impact (e.g., energy-intensive mining), promote transparency, and ensure ethical governance practices to align the crypto industry with broader sustainability and societal goals. These regulations encourage compliance with standards that mitigate risks and foster trust in digital assets.

Market cap

$2.27B #38

Circulating supply

1.85B / 10B

All-time high

$1.447

24h volume

$7.08B