Messari: Prediction markets are still close to a real explosion.

Original author: Dylan Bane, Messari Analyst

Original compilation: Deep Tide TechFlow The

application of prediction

markets has gone beyond the field of elections, demonstrating market fit (PMF).

Betting volume is surging, investors are flocking to it, and new methods from information perpetual contracts (information perps) to Telegram bots are entering the market.

So, what exactly works and maximizes trading volume growth?

– >

– >

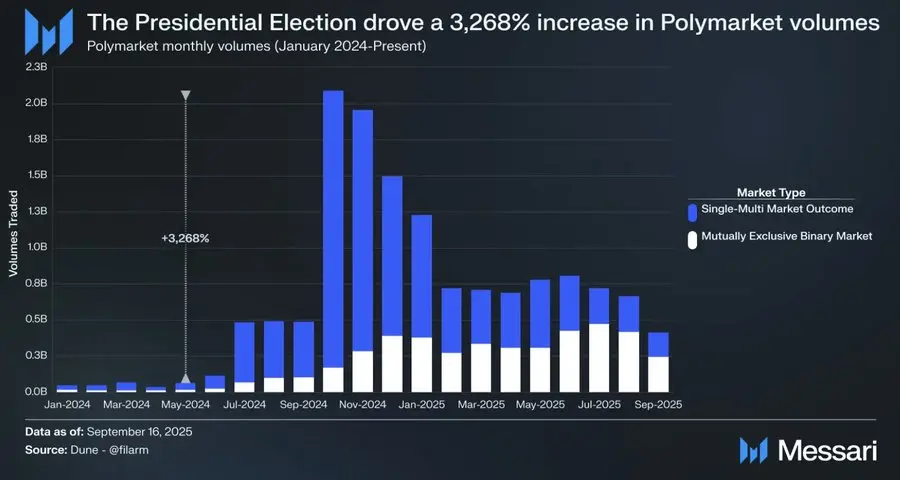

the 2024 election saw Polymarket's trading volume soar from $62 million in May to $2.1 billion in October, a 3,268% increase.

Mainstream media outlets such as CNN and Bloomberg cited Polymarket's odds in their live broadcasts, which were presented alongside traditional poll data.

In fact, prediction markets ultimately beat polls in predicting election outcomes.

– After the >

– After the >

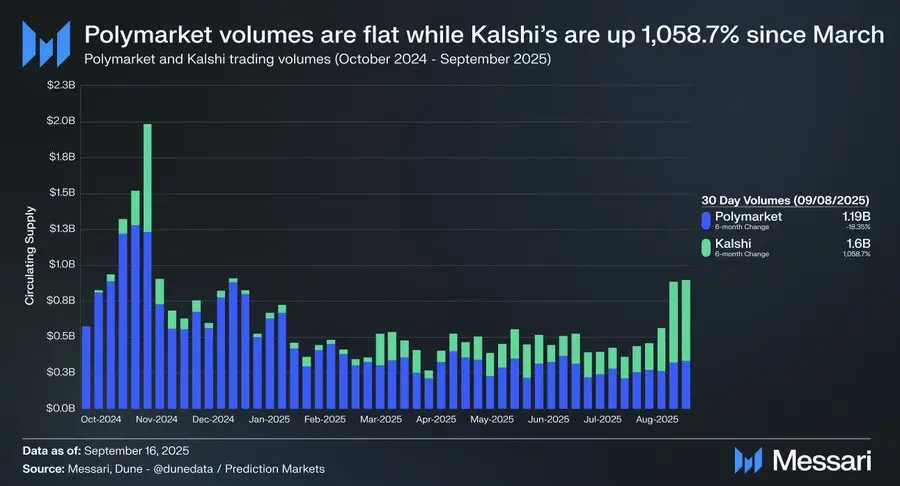

elections, the prediction market saw a decline in trading volume but remained stable at over $1 billion per month.

Combined with Kalshi's recent surge in trading volume, investors believe the prediction market has validated demand and is poised for further growth.

– >

– >

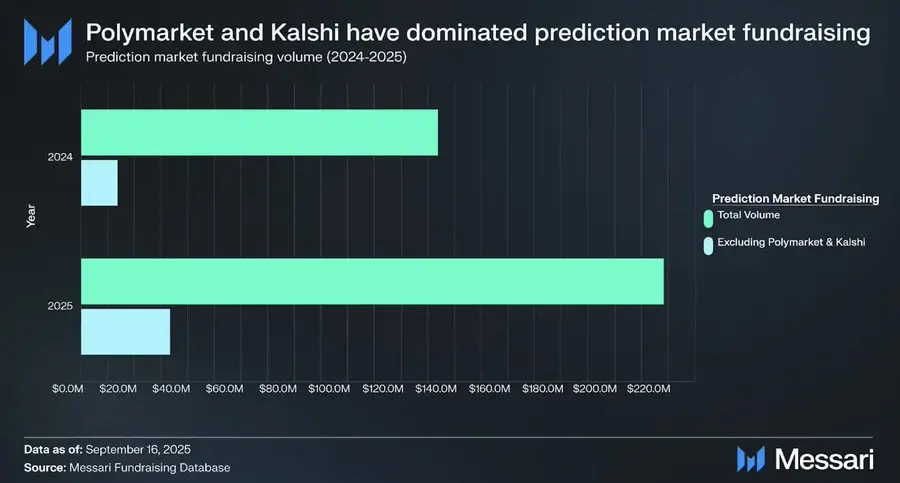

about 90% of the funding is concentrated in Polymarket and Kalshi, and the valuation is close to ten figures (i.e. billions of dollars).

These industry leaders have built liquidity and are now focusing on expanding trading volumes and strengthening market defenses, as large exchanges like Hyperliquid and Coinbase are eyeing this space.

– >

– >

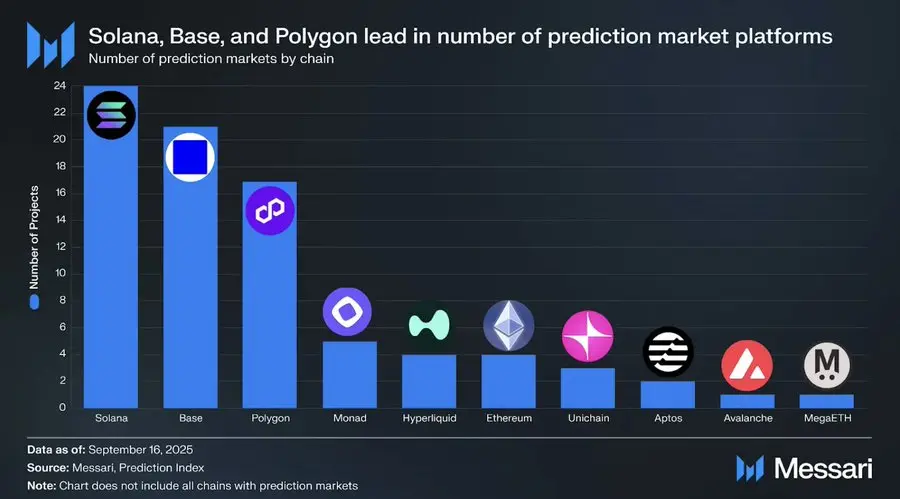

However, with over 100 prediction market projects and counting, there are plenty of opportunities in them.

The question is, how should investors find the best opportunities in this increasingly complex and noisy space?

– >

– >

we believe that the best way to solve liquidity problems and increase trading volume is to attract retail speculators.

Prediction markets can attract this segment by focusing on accessibility, fun, user experience, and high potential financial gains.

– >

– >

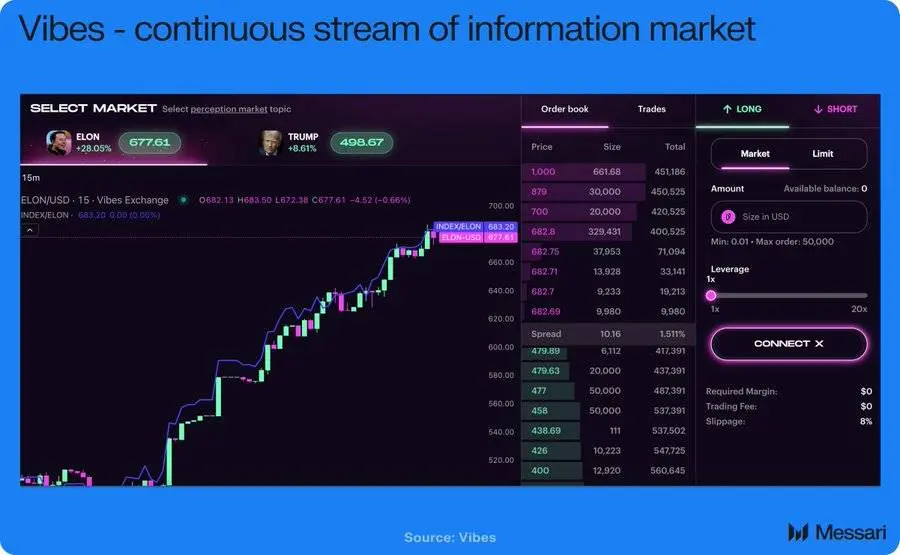

perpetual contracts overcome the problem of slow settlement in binary outcome markets that hinder speculators due to constant volatility.

Such perpetual contracts can also track interesting and easy-to-understand topics that do not currently have an existing market.

– >

– >

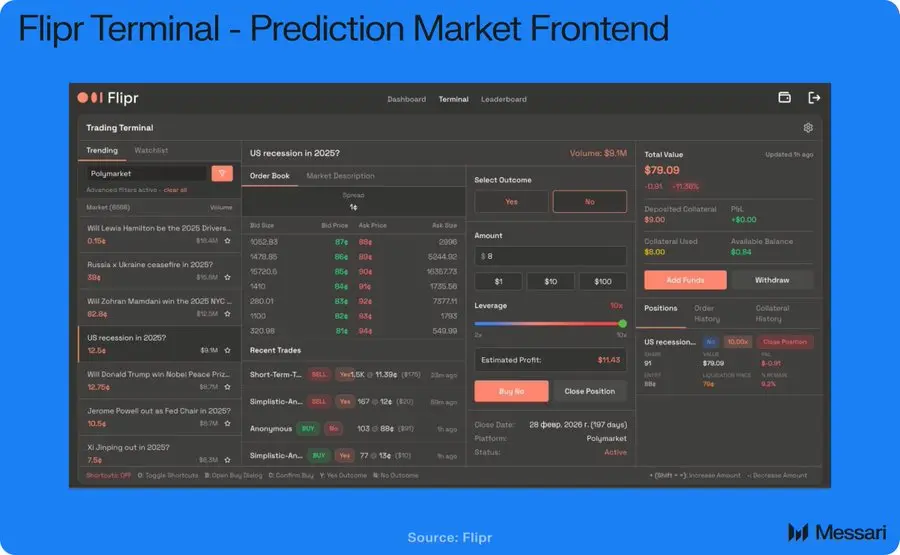

front-end platform

Rather than building native liquidity, startups can source supply from existing industry leaders and provide users with a higher quality trading experience.

For example, Flipr offers a trading terminal, trading bots on the X platform, and leverage up to 10x leverage with existing liquidity.

– >

– >

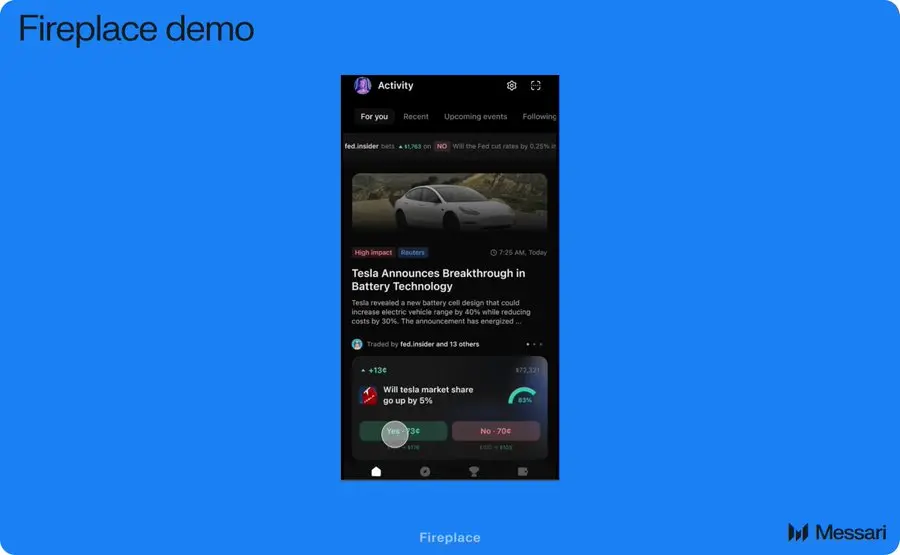

social apps

Gamified apps or social experiences can make predictions more interesting.

Just as sports betting is inherently a social experience, prediction markets can foster a similar interactive experience.

– >

– >

has a wide design space in the early stages of prediction market adoption.

Basket trading, managed indices, celebrity copy trading, parlays, and many more innovative forms are worth exploring.

Click to learn about ChainCatcher's recruitment positions

Recommended reading:

DeFi iconic symbols MKR and DAI have officially come to an end, how can SKY re-carry market expectations?

NAKA stock price plummeted 54% in one day, and the market is starting to get tired of DAT?

Base Chain Coin Launch Coming Soon? 6 items to watch

return tothe throne, Pump.fun Resurrection